Every person residing in the UK is taxed on his or her income and is subject to UK personal income tax. There are four types of income tax namely: real estate, personal estate, professional and various other incomes, each of which is subject to its own tax jurisdiction.

HMRC collects the income tax on behalf of the government. The income tax is used to provide funding for public services like NHS, education & welfare department and investment in public welfare projects like housing, railways and roads.

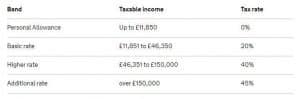

From April 2018, the standard personal allowance increased to £11,850, this is the amount of money you can earn before you pay any income tax. The higher rate tax threshold increased to £46,350, this is the amount at which anything earned above this amount is taxed at a higher rate.

The Personal Allowance may be larger if you claim Marriage Allowance or Blind Person’s Allowance. It’s also smaller if your income is over £100,000. The amount of Income-tax to be paid by you increases with increment in your income.

Along with personal income tax, you will also have to pay National Insurance on the money that you earn. Paying National Insurance means you qualify for certain benefits as well as for the state pension when you reach the state retirement age. National Insurance is paid if you are over 16 years old and earn above £162 per week.

You also pay if you are self-employed and make over £6205 profit per year. To pay National Insurance you need a National Insurance Number. The number is used for other reasons which you can read about here.

There are different national insurance classes depending on a number of different factors including your employment status, how much you earn and if there have been gaps in paying National Insurance. You stop having to pay national insurance once you reach the state pension age. Class 1 national insurance for employed people during the year 2018-2019 is 12% for earnings between £162 and £892 per week and 2% for amounts above £892 per week. The other classes refer to different types of employment and are paid according to different rules.

Statistics show that 80% of taxpayers have benefited from having a professional tax accountant who takes care of their personal income taxes. At A to Z Accountants, we understand your concern about the right payment of your income tax to the Government.

We are professionals and specialise in providing accurate personal income tax advice. Our team is aware of the ins and outs of tax payments and the latest changes in tax code, tax breaks, tax credits, tax deductions etc.

If you need help in understanding your UK tax liabilities, A to Z Accountants is here to guide you. Please give us a call today to schedule your free consultation! Or fill out a contact form and we’ll respond within 24 hours.

Tel: 0121 456 1000 Fax: 0121 456 3000 Email: info@atozaccountants.co.uk